Dark Data by Crediblock.com opens up another side of Wall St. you've never seen.

Now anyone can access the same data used by Wall St. insiders, hedge funds, and professional traders.

Disruptive Dark Data (DDD) provides a big data analytics services for consumers, traders, investors, institutions, and programmers.

DDD1 – Deep Whale - Insider trading activity, 13F fund data

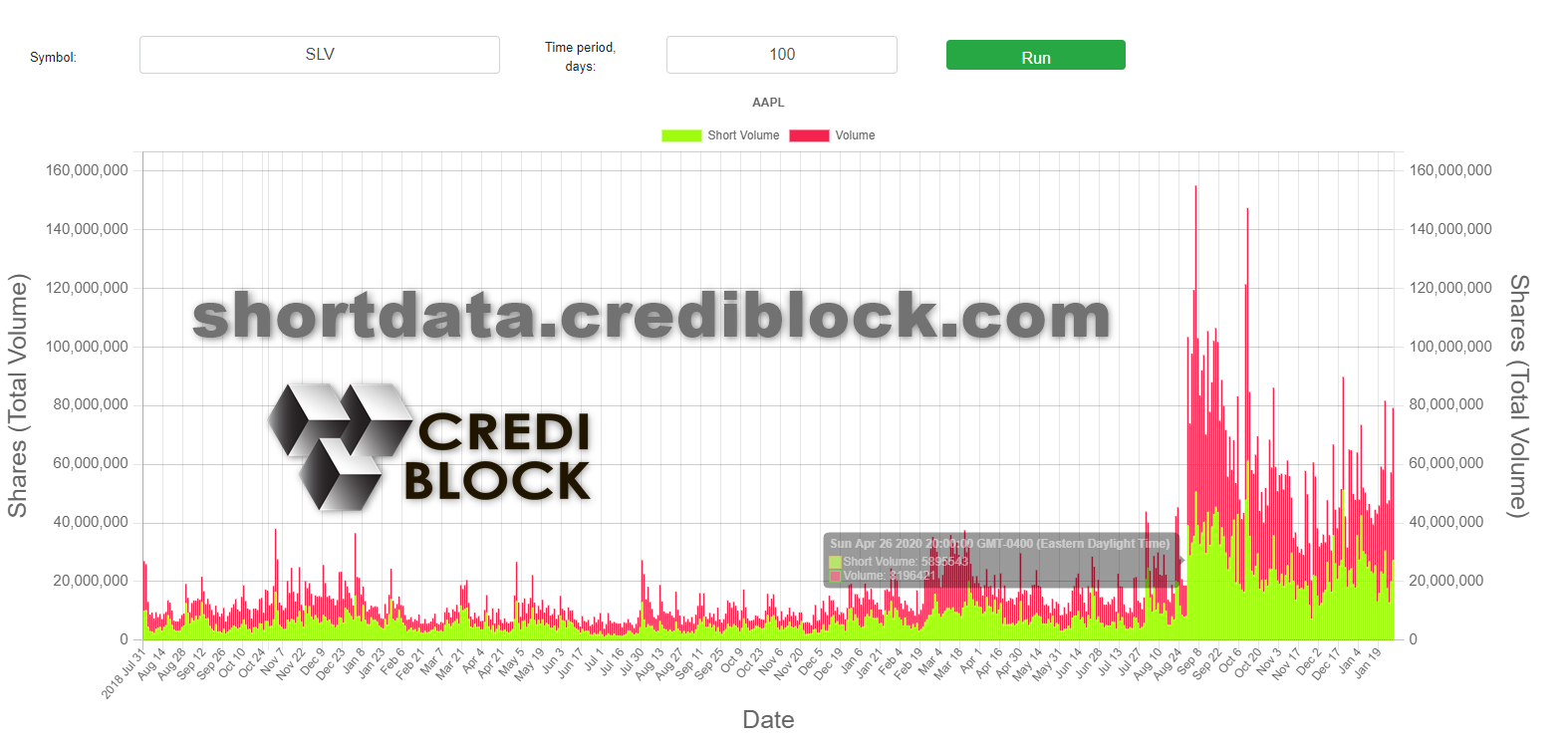

DDD2 – Stock Short Sellers, Borrow rates, Net Open Short positions

DDD3 – Pre IPO - "Hot List" of Pre IPO companies

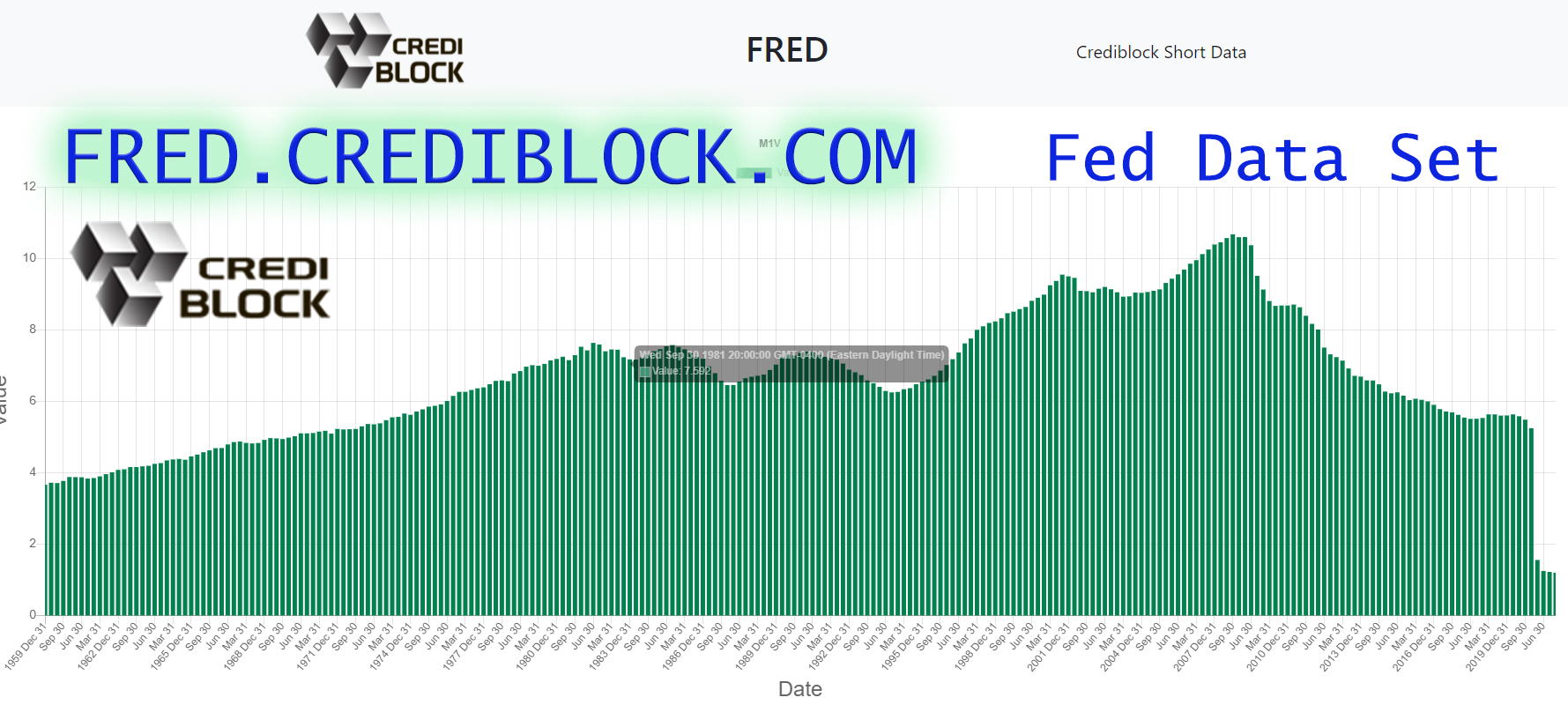

DDD5 – Money Supply and other Fed data

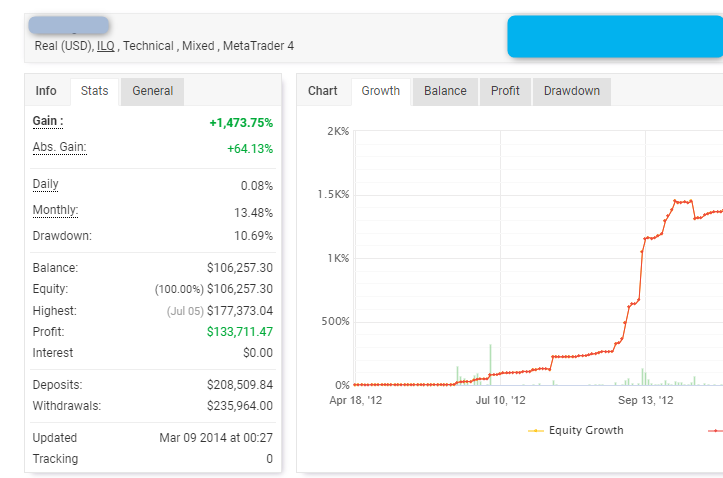

Total volume of short sales SLV

Disruptive Dark Data

Normally $49$35.00

/month

- Custom API calls - White Label

- Custom installation and support for your organization

Real Time Dark Data

Normally $150$99.00

/month

- Custom API calls - White Label

- Custom installation and support for your organization

Enterprise API

Normally $499$249.00

/month

- Custom API calls - White Label

- Custom installation and support for your organization

“If we knew what were doing it wouldn’t be called research.” - Albert Einstein

Fed data including Money Supply, Velocity of Money, and others

This is a great place for a testimonial.

Bell Schuster

What is 'Dark Data'

The dark web is simply non-public - it's not private. Markets provide lots of public data such as pricing, you can get the price of a stock from Google. Hedge funds and other institutions file reports on their public market positions via 13F - this is an example of 'dark' data. Dark data is not private data.

Where do you get the data from?

From a number of sources including government regulators, self-regulatory organizations or SROs, exchanges, data vendors, and by searching/crawling.

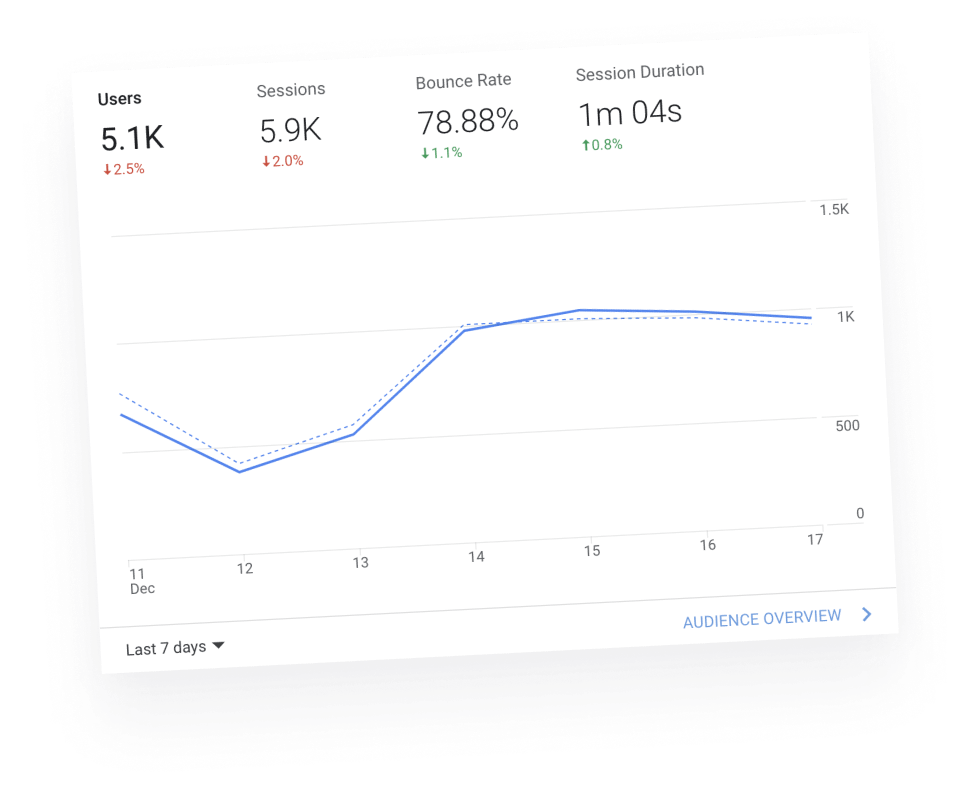

What is the best tool to increase web traffic fast?

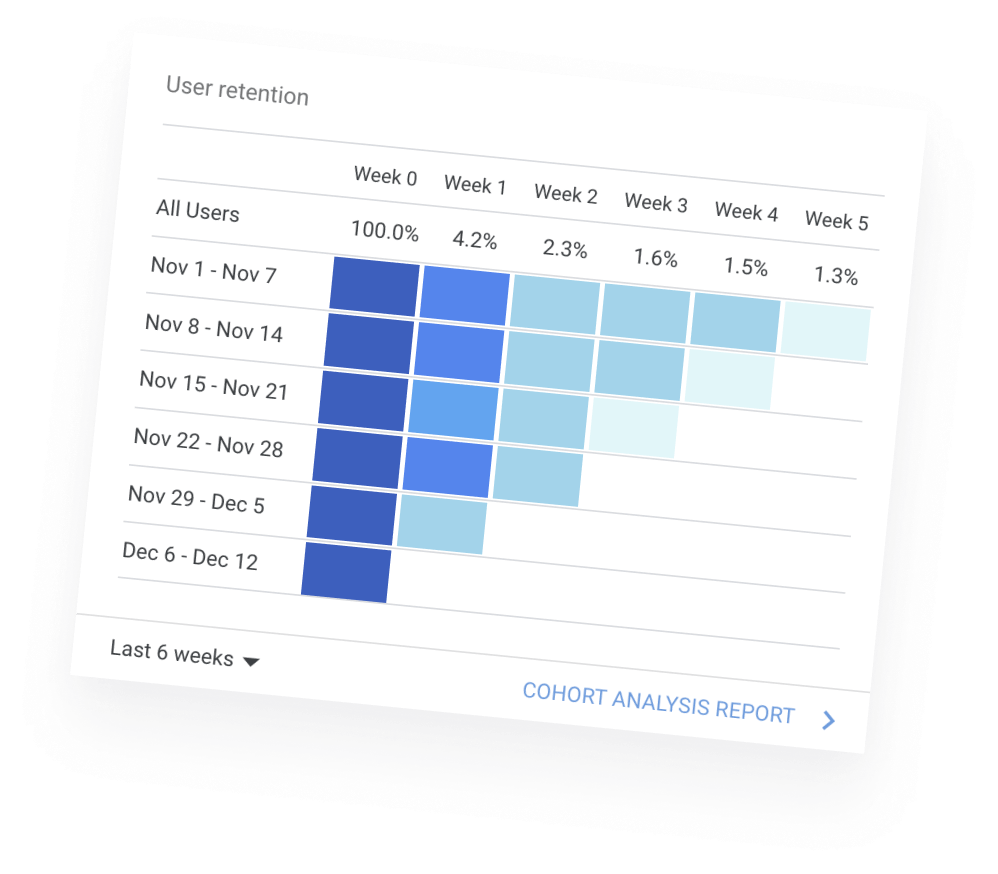

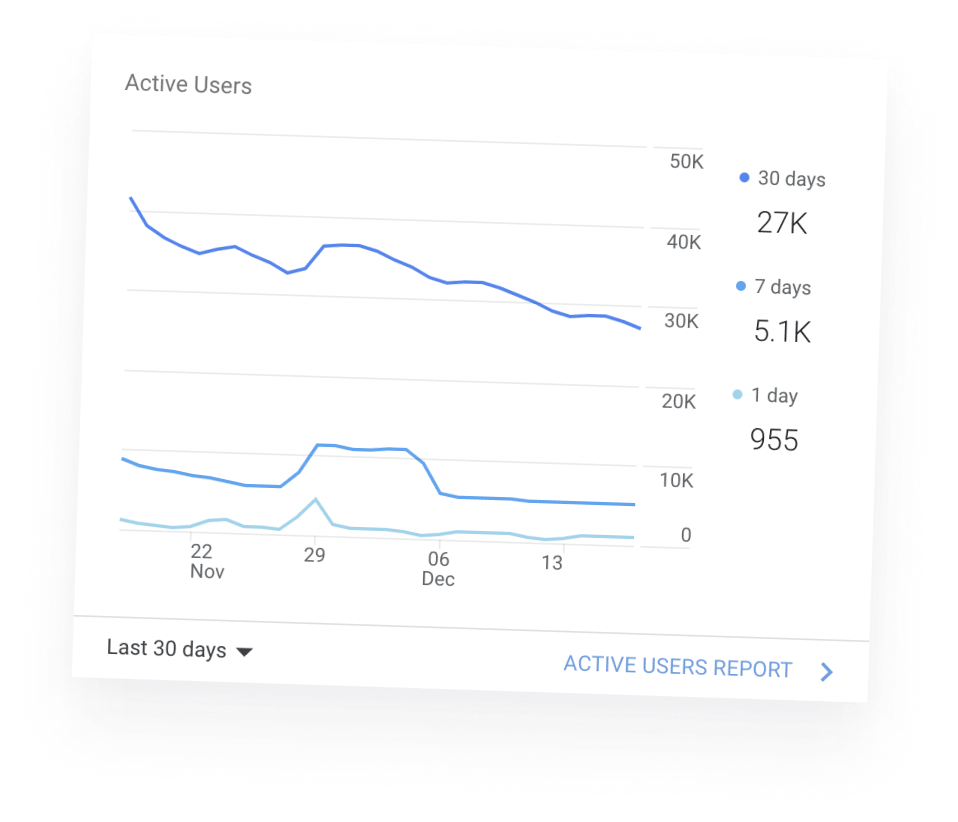

Google Analytics provides free website and web page traffic tracking. Register your website with Google Analytics and receive a unique code. Use this code on each web page to allow tracking. See website traffic in real time and for any date range. Other data available includes country or origin, device type, page views, time on page, web page speed and traffic source.